RAMALLAH, Union Construction and Investment’s (UCI) financial results for the first half of 2018 demonstrate that it is the most profitable real-estate company on the Palestinian Securities Exchange – by a large margin.

According to the financial statements of UCI for the first half of 2018, the net profit after tax for the 6-month period reached $901,508. This constitutes an increase of 65.14% compared to the net profit after tax of $545,913 for 2017.

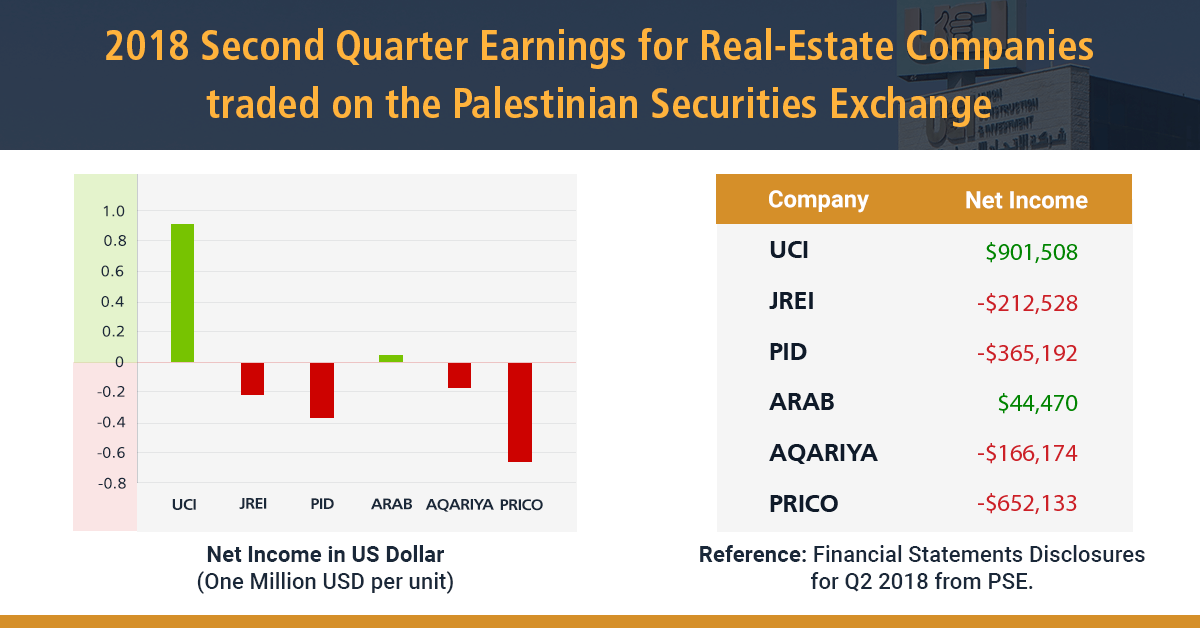

Compared to the financial disclosures of competing real estate development companies listed on the Palestine Exchange (PEX) for the same period, UCI is the leading real estate company in terms of profitability. UCI has achieved the highest profit rate among the real estate development companies listed on the PEX for the first half of 2018.

The Arab Investors Co. (ARAB) announced net profits of only $44,470 for the first half of 2018. All other real estate companies announced losses for the first half of the year. The Jerusalem Real Estate Investment Co. (JREI) announced net losses of $212,528, the Palestine Investment & Development Co. (PID) announced a net loss of $365,192, the Al-Aqariya Trading Investment Co. (AQARIYA) announced a net loss of $166,174, and the Palestine Real Estate Investment Co. (PRICO) announced a net loss of $652,133.

Positive Progress for UCI

“The strong financial performance of UCI during the first half of the year reflects the hard work and dedication of the UCI team to create new innovative projects and grow of its customer base. UCI has garnered a distinctive reputation for the uniqueness, design and construction quality of its projects, in addition to a commitment of completing its projects on the determined time,” said Eng. Khaled Sabawi, UCI’s General Manager and Vice Chairman of its BOD.

Mr. Sabawi expressed his happiness for the sale of all 64 residential units of the Masyoun Gardens 1 project in record time. He talked about the sales of Masyoun Gardens 2, which was launched quickly after the sellout of all the apartments in Masyoun Gardens 1. These residential projects are part of the series of Masyoun Gardens residential projects on the lands owned by the company in the prestigious and high demand neighborhood of Al Masyoun, in Ramallah, as well as the expansion and development works of TABO project in conjunction with these activities.

Major Investment Opportunity

Referring to UCI stock price, Mr. Sabawi stated “In spite of the fact UCI continues to outperform all competitors, the market price of its share is 64 cents. This is very low considering the book value of UCI’s share – the value of the share price according to UCI’s audited financial statements - is $1.24. In my opinion, this presents and excellent investment opportunity for those interested in investing in Palestinian stock market.”

About UCI

Union Construction and Investment (UCI) is one of the largest construction and real-estate development companies in Palestine. Established in 2005 by a group of distinguished Palestinian and Arab business leaders underpinned with decades of experience and supported by investment companies in the Arab world, UCI has changed the culture of Palestine’s residential and commercial development. UCI has constructed landmark buildings including the environmentally friendly UCI Headquarters Building in the Masyoun Heights of Ramallah, the Arcadia Residential Complex, and the first residential housing project in the West Bank, the Etihad Villas. UCI also implemented TABO, a leading real estate project in Palestine that makes it possible for Palestinians at home and abroad to own a parcel of land with a title deed at affordable prices in their homeland.

UCI has recently sold out of its 64 unit Masyoun Gardens 1 building and has launched its new Masyoun Gardens 2. UCI has already started selling apartments in Masyoun Gardens 2 and has recently finished its excavation works.